DeFi Protocol Suite

Full-stack DeFi ecosystems with staking, lending, and yield optimization.

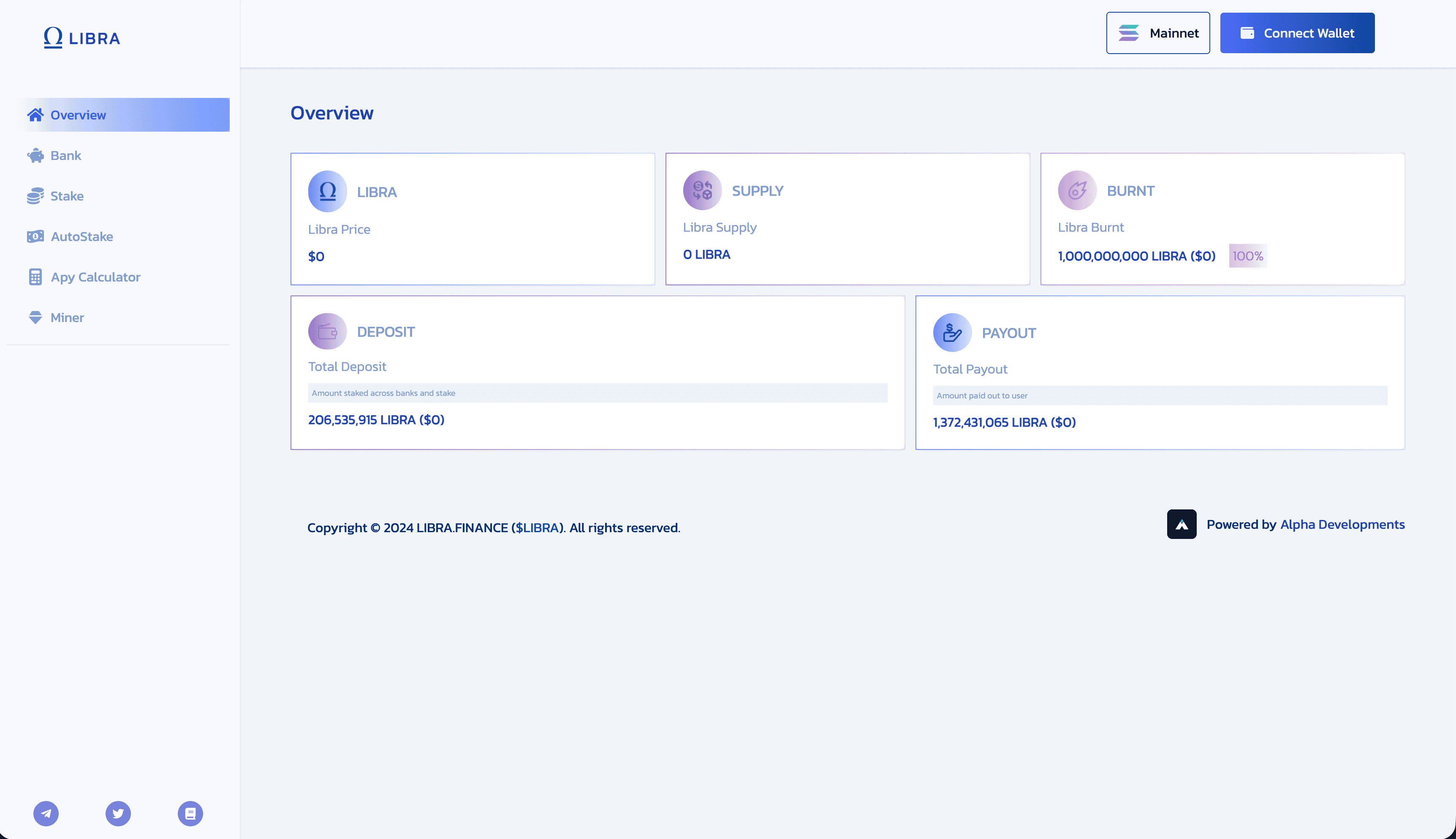

Overview

We build comprehensive DeFi ecosystems (Insora, Libra Finance-style) that integrate staking, lending, borrowing, yield optimization, and governance into unified platforms. These protocols handle complex financial logic including multi-protocol yield aggregation, capital-efficient cross-margin systems, and automated strategy execution.

Our DeFi solutions are built for both retail and institutional users, with a focus on capital efficiency, transparent yields, and seamless user experience.

Core Concept

Deposit → earn optimized yields → borrow against collateral → participate in governance.

Complete DeFi ecosystems that maximize capital efficiency while maintaining security and transparency.

The Problem

DeFi users must navigate multiple fragmented platforms to access different financial services, leading to poor capital efficiency and complex user experience.

Our Solution

- →Unified platform for all DeFi needs

- →Automated yield optimization

- →Capital-efficient lending markets

- →Integrated governance systems

What We Build

Multi-protocol yield aggregators

Lending and borrowing protocols

Staking and rewards systems

Governance tokens and DAOs

Comprehensive DeFi dashboards

Related Projects

View All →Advanced Trading Systems

Comprehensive suite of trading tools for competitive advantage.

Solana Infrastructure Suite

Custom Solana programs for mining, staking, and advanced tokenomics.

Crypto Payment Platform

Custom Stripe-like crypto payment solution on Solana.